At Priority Tax Relief our primary goal is to provide valuable guidance to clients who find themselves facing the complexities of the IRS Currently Not Collectible (CNC) status. This status can be a lifeline for individuals in dire financial straits, and understanding how to navigate it is crucial. In this comprehensive guide, we’ll dive into CNC status, its application process, eligibility criteria, and the benefits it offers. We’ll also explore the limitations, address IRS notices, discuss the importance of working with a full service tax resolution firm, and tackle the intricacies of handling of complex tax situations. Let’s begin by diving deeper into what CNC entails.

What Is CNC Status and what does it mean for my IRS debt?

CNC, short for Currently Not Collectible status, or Status 53 is a designation by the IRS that temporarily suspends collection efforts against you due to your financial hardship. This essentially means that the IRS acknowledges your inability to pay your tax debt at the current moment. Think of it as a temporary respite, allowing you to regain financial stability when life’s circumstances take a challenging turn.

Obtaining Currently non Collectable can be a critical relief for individuals struggling to make ends meet. However, it’s essential to recognize that it’s not a long-term solution. Your tax debt doesn’t vanish; it’s merely put on hold temporarily. During this period, interest and penalties may continue to accrue, and the IRS will closely monitor your financial situation.

How to Apply for currently not collectible status

Applying for currently not collectible status from the IRS isn’t as straightforward as filling out a simple form. To request this status, you need to submit a formal application, typically in the form of a 433.

- IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals

- IRS Form 433-F, Collection Information Statement

- IRS Form 433-B, Collection Information Statement for Businesses, before making any collection decision.

These forms are comprehensive and require detailed financial information, including your income, expenses, assets, and liabilities. Accuracy and thoroughness are essential when completing these forms, expect the IRS to meticulously scrutinize your finances. If you are working with a reputable tax professional they will assist you if filling out the proper forms, calculate allowable expenses, and review your financials.

Eligibility Criteria

Ability to Pay

Not everyone is eligible for uncollectable Status. To qualify, you must demonstrate to the IRS that paying your tax debt would cause financial hardship. This could mean that your monthly income is barely sufficient to cover your basic living expenses, leaving no room to pay your tax bill. Meeting the eligibility criteria is critical, and providing documentation to support your claims is essential.

The IRS Review Process and Qualifying for CNC Status

Once you’ve submitted your CNC status application, the IRS will embark on a careful review of your financial information. During this review, they’ll assess whether you meet the criteria for CNC status and whether your financial situation warrants temporary relief from collection efforts. It’s crucial to be transparent and honest about your finances during this process. The IRS will go to great lengths to ensure you’re not concealing any assets or income.

Benefits and Limitations of CNC Status

CNC status offers several notable benefits, including relief from IRS collection actions. This means that wage garnishments, bank levies, and other aggressive collection efforts are temporarily halted. It provides you with some breathing room to stabilize your financial situation, allowing you to focus on meeting your basic living expenses.

However, it’s vital to understand that CNC status is not a permanent solution. As mentioned earlier, your tax debt doesn’t disappear; it’s merely paused. During your CNC status, interest and penalties may continue to accrue, and the IRS will continue to monitor your financial situation closely.

Dealing with IRS Notices

While in CNC status, it’s essential to be aware that you may still receive IRS notices and correspondence. Addressing these promptly is crucial. Ignoring IRS notices can lead to the removal of your CNC status and a resumption of collection actions. Your tax attorney can assist you in responding to these notices appropriately and ensuring that your status remains intact.

Working with a Tax Attorney

Navigating the complexities of CNC status and dealing with the IRS can be overwhelming and daunting. This is where a knowledgeable tax attorney can be your most valuable ally. A tax attorney can help you navigate the application process, negotiate with the IRS on your behalf, and ensure that your rights are protected throughout the entire journey. Their expertise can be a game-changer in achieving a favorable outcome. Expertise plays a major role of knowing what may remove you from CNC status, or possibly what could reset statute of limitations.

Handling Federal Tax Liens

If you already have received a notice of federal tax lien filed against you, obtaining CNC status may not automatically remove it. However, it can halt further collection efforts. It’s essential to consult with a tax professional to explore options for addressing existing tax liens and preventing new ones. Your tax professional can guide you through the process of dealing with tax liens effectively.

* IRS will likely file a lien if you owe more then $10,000.

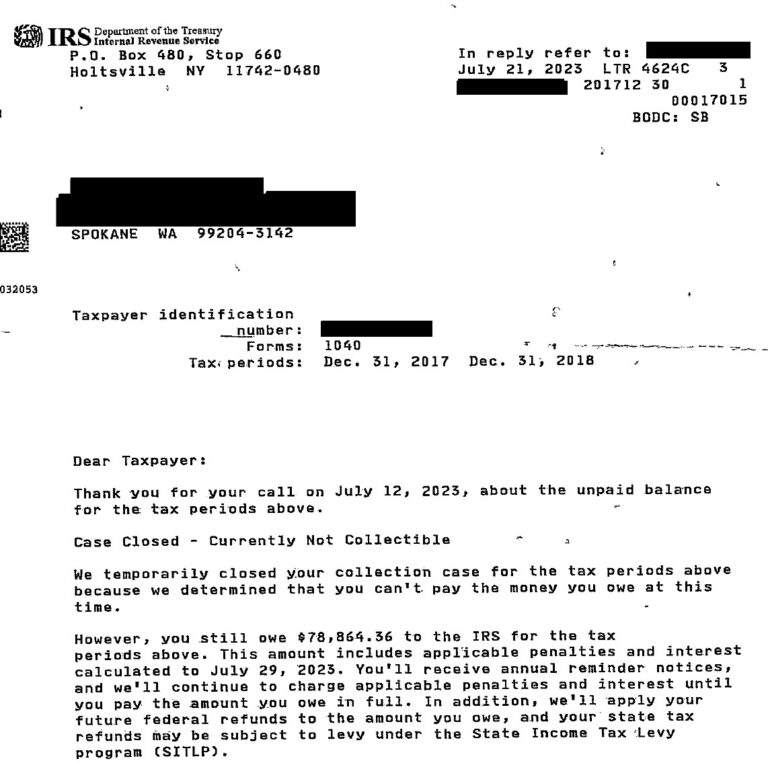

Related IRS notices:

Keep in mind IRS will send notices while "currently not collectible". Your tax liabilities are not absolved even though collection actions are suspended.

- CP-501, 503, 504 notices

- IRS May file Liens

- Account is in CNC status letter

- CP 14 Letter

- Any other Non Collection Letters/Notices

- CP 71

Priority Tax Relief Client CNC Letter

Conclusion

Currently Not Collectible (CNC) status from the IRS can provide much-needed relief to individuals facing financial hardship and cannot afford to pay their debt with the IRS. While it is a valuable option, it comes with its own set of complexities and considerations. Consulting with a tax attorney who specializes in IRS matters can make all the difference in successfully navigating the process, regaining control of your financial situation, and working toward a more stable future. If you’re facing IRS collection efforts or considering CNC status, don’t hesitate to Call Priority Tax Relief. We are experienced at IRS negotiations with an A+ Rating with the BBB and 20+ years of Experience to back it up.

Frequently Asked Questions:

What If You Don't Qualify for CNC Status?

If, after a thorough review, you find that you don’t meet the eligibility criteria for IRS currently not collectible status, all is not lost. You may still have other avenues for resolving your tax problem. These options may include:

- Setting up a payment plan with the IRS.

- Negotiating an Offer in Compromise, which allows you to settle your tax debt for less than the full amount.

- Exploring other tax relief programs that could be suitable for your specific situation.

Consulting with a tax professional, particularly a seasoned tax attorney, can help you identify the best course of action based on your unique circumstances.

Why should you consider contacting an IRS tax attorney regarding IRS CNC status?

A tax attorney can provide invaluable guidance throughout the CNC application process, ensuring that you meet the necessary requirements and that your rights are protected when dealing with the IRS.

What if you file a tax return and owe while you’re in CNC status?

If you owe additional taxes while in account is placed in CNC status, it’s essential to address this issue promptly. Failure to do so can jeopardize your uncollectible status and result in collection actions. Its Important to work with a team to ensure proper calculations are made on tax returns; file your your tax return on time, and pay on time.

What if I am facing a federal tax lien?

If you have a federal tax lien, CNC status can provide relief from further collection efforts. However, it doesn’t automatically remove the existing lien. Consult with a tax professional to explore lien subordination options.

What Information Is Needed to Request Currently Not Collectible Status?

To request non-collectible status, you’ll need to provide detailed financial information, including your income, expenses, assets, and liabilities. This information is crucial for the IRS to assess your eligibility. The IRS will want you to prove to the IRS you cant afford to pay your tax liabilities at the present time.

What Are IRS Allowable Living Expenses?

The IRS has specific guidelines for allowable living expenses when determining CNC eligibility. These expenses cover basic necessities such as housing, food, clothing, transportation, and healthcare.

How Long Can I Stay in Currently Not Collectible Status?

The duration of CNC status can vary based on your financial situation and the IRS’s assessment. It is generally granted on a temporary basis until your financial situation improves. If your situation does financial stability does not improve you can remain in CNC until Collection Statute Expiration Date (CSED) Expires. Rendering the Debt Expired and IRS can no longer collect or attempt to collect the debt.

What is the Differences of Status 53 and CNC?

Status 53 is a designation reserved for individuals with outstanding tax debts from previous years who presently lack the means to settle those obligations. The IRS categorizes the taxes owed by individuals in Status 53 as "currently not collectible," and these two terms are frequently used interchangeably to describe the same situation.