Priority Tax Relief provides tax relief services

such as

Offer in Compromise

Installment Agreement

Currently Not Collectible

Penalty Abatement

Innocent Spouse Relief

Our Mission

The Internal Revenue Service says that Americans owed more than $120 billion in back taxes, fines, and interest in 2022 alone. At Priority Tax Relief, we make it our goal to make tax relief and help more accessible to the average American and their families.

Our Vision

Priority Tax Relief sees a future where the average American is able to enjoy their lives and taxpayer rights with their families through accessible tax relief aid. Here at PTR, not only do we make that possible but we also empower our clients.

Team of A+ rated Tax Professionals

We are a team of highly qualified Tax Attorneys, Enrolled Agents, Certified Public Accountants and Associates who are here to help you find the best solution available, to resolve your tax problems quickly and efficiently. We recognize this is a difficult time for you and you are looking for help.

Our Tax Professionals have years of experience successfully negotiating thousands of cases. Our team of Tax Relief Expert Advisors are highly trained and will be able to assist you in determining the best course of action to resolve your tax issues. Whether it’s about tax levies, wage garnishments, bank attachments, offers in compromise, innocent spouse or other tax related issues, we can help and answer your questions. Unlike many other tax relief companies, we follow-up and keep you informed every step of the way until your case is resolved. Priority Tax Relief offers an ongoing Client Support Line.

Any questions or requests for case updates are answered directly by one of our qualified consultants.

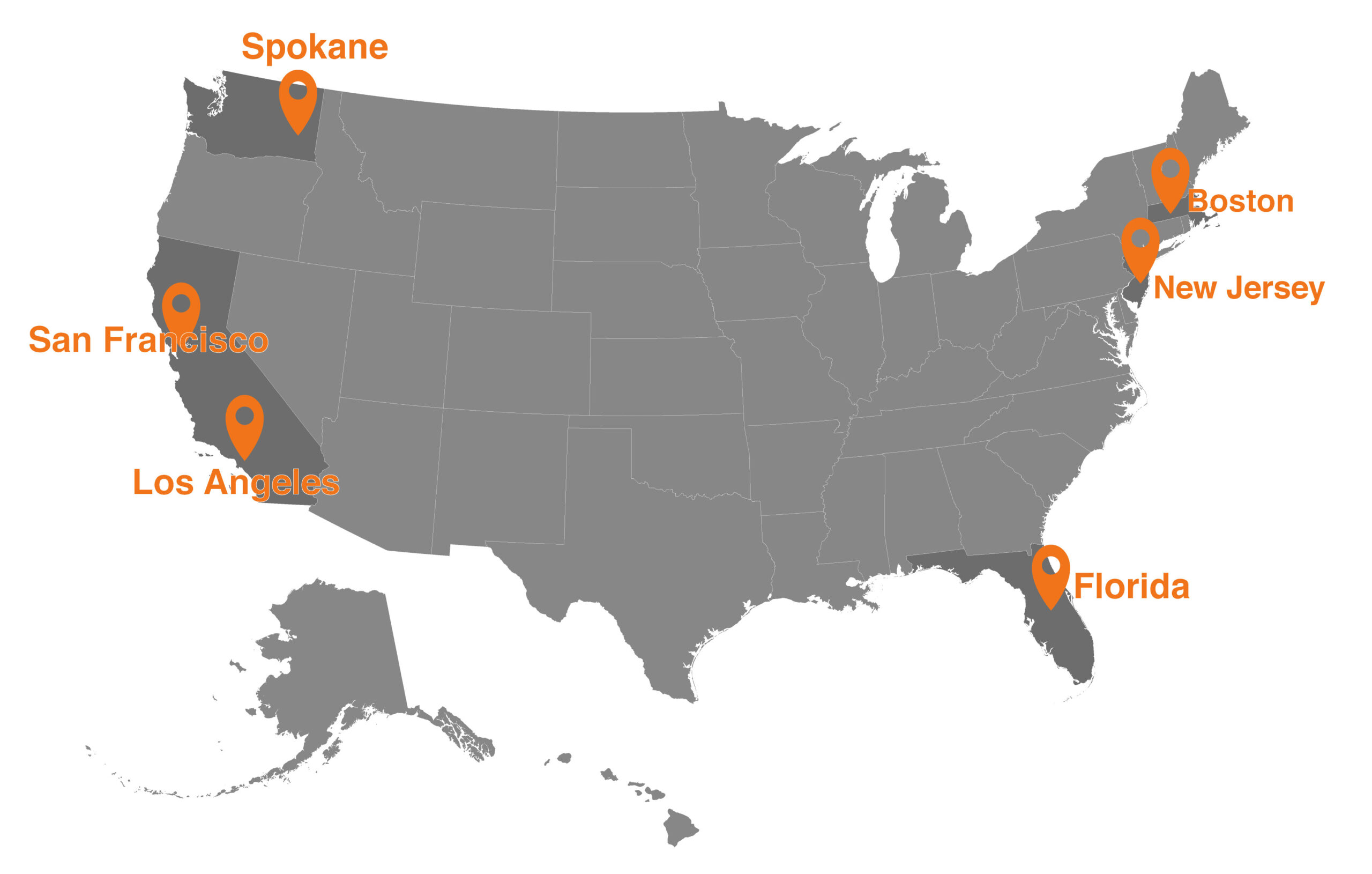

Our Business Locations

Boston

Branch Office

Florida

Branch Office

San Francisco

Head Quarters

New Jersey

Branch Office

Spokane

Business Hub

Los Angeles

Branch Office